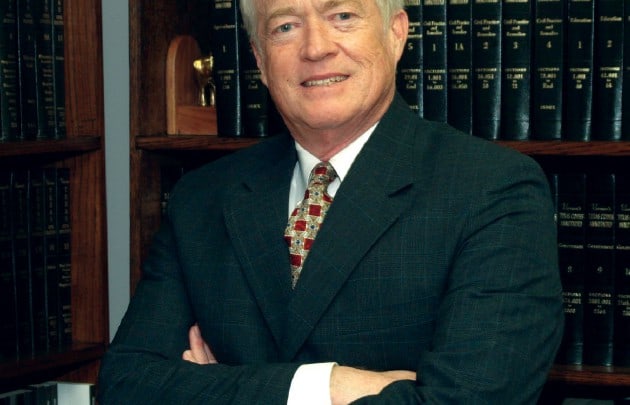

Judge Sadler Business Assets Show Up In Indicted Partner’s Homestead Property Tax Account

Judge Alan Sadler and his indicted partner Aslam Kapadia may have some explaining to do to the feds, according to public records at the Ft. Bend County Tax Office and the Texas Business & Commerce Code, Section 24.001 and 24.005 also known as the Uniform Fraudulent Transfer Act (UFTA).

The latest entry at the Ft. Bend County Tax Office for Kapadia’s homestead on Harbor View Drive in Sugar Land (Acct. No. 6850010010120907) shows that on 1/30/09 Development II Partners, Inc. paid Kapadia’s 2008 homestead taxes in the amount of $8,159.38.

Development II Partners, Inc. was one of Kapadia and Sadler’s gas station/convenience store 50/50 partnerships at the time of the eight thousand dollar transfer of corporate assets to the Ft. Bend county tax assessor.

The public tax office document indicates a direct corporate payment of a private debt which looks to be an act of highly questionable financial skullduggery that was done while Kapadia was not only under federal indictment for money laundering and wire fraud but was also under a “Notice of Criminal Forfeiture” (on pages 25, 26 and 27 of his indictment) that states “all property traceable to the offense” is made subject to forfeiture to the government”. (a total of over seven million dollars of ILL-GOTTEN GAIN targeted)

After Kapadia’s arrest and arraignment on 12/29/08, his wife handed over (20) five-hundred dollar money orders equal to 10% of her husband’s $100,000 bond and she personally signed a government document titled “Additional Conditions of Release” in order to get Kapadia released to her custody.

I’ve highlighted the last condition of Kapadia’s release listed under paragraph (v) of that document; “defendant shall advise Pretrial Services of any/all new commercial and/or residential real estate and/or financial transactions”.

Kapadia assets were clearly placed in the bulls-eye of the federal government by virtue of the forfeiture clause in the indictment and also under his “conditions of release”.

Sadler, with his finance degree and banking background, surely knows that payments of an officer’s personal debts “directly” from a corporate bank account without withholding federal income and FICA taxes (from both the employee AND the company) is often attempted when desiring to make a fraudulent transaction look like a legitimate deductible “expense” on the business’s books when in fact it’s really personal “income” that is intentionally not run through payroll because it’s not going to be reported as such to the IRS by either the company or the individual.

I believe, if these corporate funds (used to pay Kapadia’s property taxes) are found to have bypassed the payroll process and were not legally declared, this could possibly be another “new” act of money laundering which the feds (and the IRS) should be very interested in! Can anyone say, “IRS Audit”?